The Small Business Administration is now accepting applications through December 31, 2021 for the Targeted EIDL Advance and the Supplemental Targeted Advance, but they ask that you apply by December 10. These two combined provide $15,000 in assistance for eligible applicants that does not need to be paid back.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

First, in order to apply for the Targeted Advance, your business must first apply for a COVID-19 EIDL, although you do not have to accept or be approved for that loan. The SBA will invite you via email to apply for the Targeted Advance if your business is located in one of the low-income areas. If you have already accepted the COVID-19 EIDL, your max assistance is $15,000 from all EIDL grants combined.

To be eligible for the $10,000 Targeted EIDL, you must:

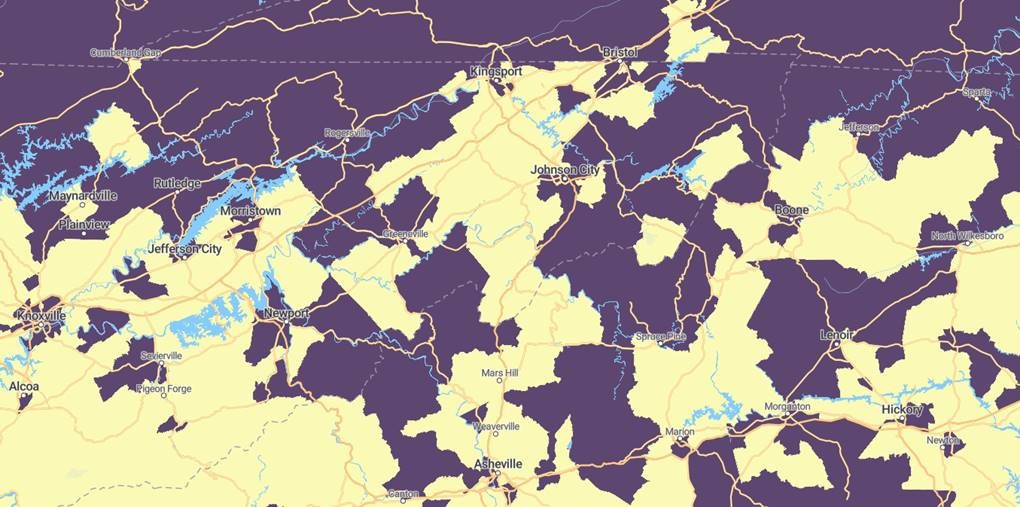

1. Be in a low income area. Click this link for the full mapping tool and use your business’s address to determine your economic area. A screenshot of East Tennessee and Western North Carolina is below. Purple areas denote low income areas.

2. Can demonstrate more than 30% reduction in revenue during an eight-week period beginning on March 2, 2020, or later. If an applicant meets the low-income community criteria, they will be asked to provide gross monthly revenue (all forms of combined monthly earnings received, such as profits or salaries) to confirm the 30% reduction.

3. Have 300 or fewer employees.

To be eligible for the $5,000 Supplemental Targeted Advance, you must:

1. Be in a low income area. Click this link for the full mapping tool and use your business’s address to determine your economic area. A screenshot of East Tennessee and Western North Carolina is below. Purple areas denote low income areas.

2. Can prove more than a 50% economic loss during an eight-week period beginning on March 2, 2020, or later, compared to the same period of the previous year. Applicants need to provide gross monthly revenue (all forms of combined monthly earnings received, such as profits or salaries) from January 2019 to the current month-to-date.

3. Have 10 or fewer employees.

While farmers are not eligible for these grants, they are eligible for the original COVID-19 EIDL. Please see the SBA’s EIDL website for more information or to apply.