By Amy Culler

As a taxpayer or tax professional, there are times when it is necessary to contact the Department of Revenue, and oftentimes, the answers received leave us with more questions. In order to combat this, the Tennessee Department of Revenue has created the Problem Resolution Office whose sole purpose is to further investigate and explain the reasons behind the answers given by the Department of Revenue, and to make sure that those answers are complete and correct. According to the Department of Revenue’s web page, the Problem Resolution Office:

- Acts as a liaison between the department’s various operational divisions in order to facilitate consistent communication and effective resolutions to individual tax issues

- Offers navigational support, when necessary, through the department’s standard problem resolution process

- Serves as a potential advocate for taxpayers who feel that they have been treated in a manner inconsistent with Tennessee’s tax laws

- Reviews taxpayer issues for administrative inconsistencies and/or incorrect application of department policies

- Identifies systemic administrative issues and provides suggestions for improvement

This office does not:

- Change or reinterpret Tennessee’s tax laws for individual situations

- Intercede in audits, hearings, collections cases, or requests for penalty waiver or refund (Respective divisions should be contacted directly for assistance)

- Provide general account information or assist with filing returns

- Act as legal counsel

- Reduce tax liabilities or overturn assessments

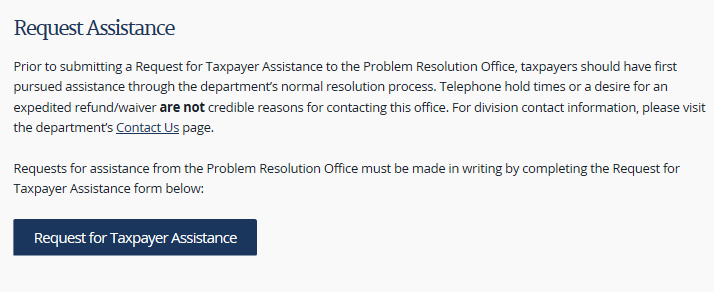

The Problem Resolution Office should not be used initially to circumvent normal channel due to long hold times or to rush the process along. It is a resource to help taxpayers and tax professionals understand the reasons behind the answers given by the department and answer any remaining questions. To access the Department of Revenue’s Problem Resolution Office, visit: https://www.tn.gov/revenue/topic/problem-resolution-office and click the “Request for Taxpayer Assistance” button located at the bottom of the page.

For answers to frequently asked questions, you can visit: https://revenue.support.tn.gov/hc/en-us. As always, the MAS department at BCS is happy to assist you in any way we can!