By Teresa Adams

The Tennessee Department of Revenue has launched the second phase of TNTAP (Tennessee Taxpayer Access Point). As of the end of May 2018, the following taxes were added to the website:

- Franchise and excise tax

- Business tax

- Hall income tax

- Motor carrier taxes and fees

If you already have a TNTAP logon and need access to any of these tax types above, you will need to add the tax accounts to your existing TNTAP login. Watch the following video for step-by-step instructions.

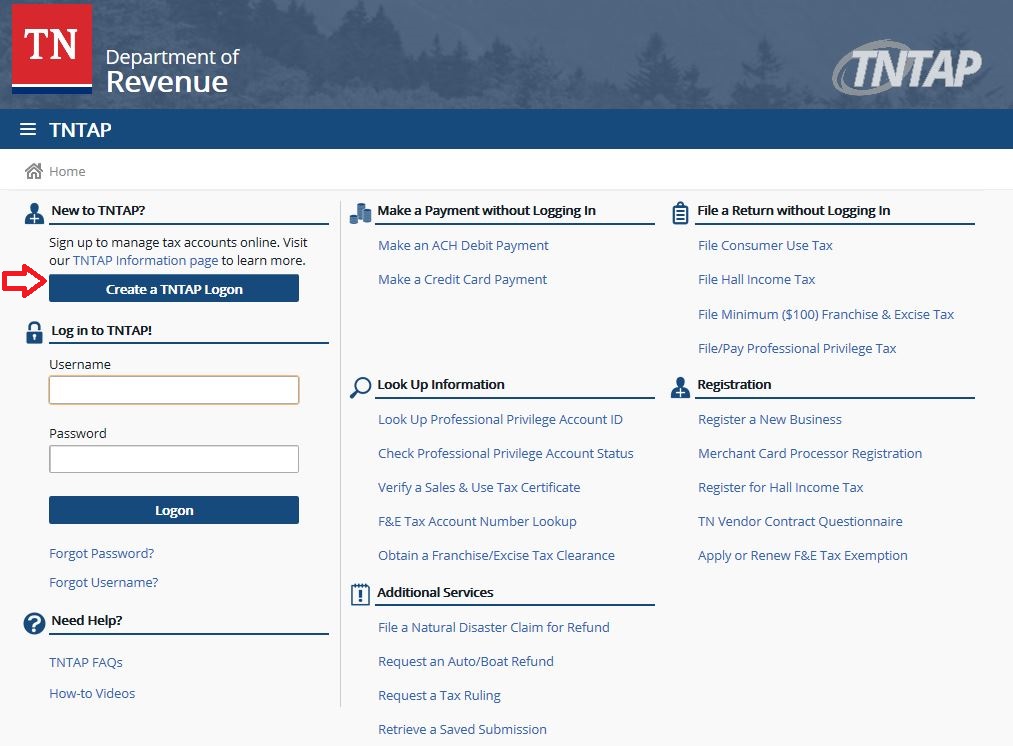

If you do not have a TNTAP logon, you can create one now by selecting “Create a TNTAP Logon” from the home page of TNTAP. Once you have established your logon, you will then be able to gain access to your tax accounts. Go to the TNTAP website by clicking here.

Before you start, you will need a few items to setup your account, including:

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

- Business name

- Account number, account type and zip code

- One of three past payment amounts or a Letter ID from TNDOR

- Valid e-mail address

Watch the following video for step-by-step instructions on how to setup your login and add access to a tax account.

If you have any additional questions or need any assistance setting up your TNTAP account, please give us a call at (423) 282-4511.