By Kathleen Gemar

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

At Blackburn, Childers, and Steagall, our tax department strives to provide premier service and exceptional communication to our clients. We are constantly looking for ways to improve the efficiency and simplicity of processes for the benefit of our staff, but most importantly, the client experience. Our newest initiative to improve our services is the implementation of an innovative interface known as SafeSend. SafeSend is a secure, user friendly, software that takes the hassle out of traditional paper-filing for both the client, and the tax preparer. SafeSend will be available per request during 2023. Beginning in 2024, you will also be able to receive your engagement letter and client organizer via SafeSend. The organizer will be completely fillable and can be completed anytime at your convenience. Please mention to your tax preparer if you are interested.

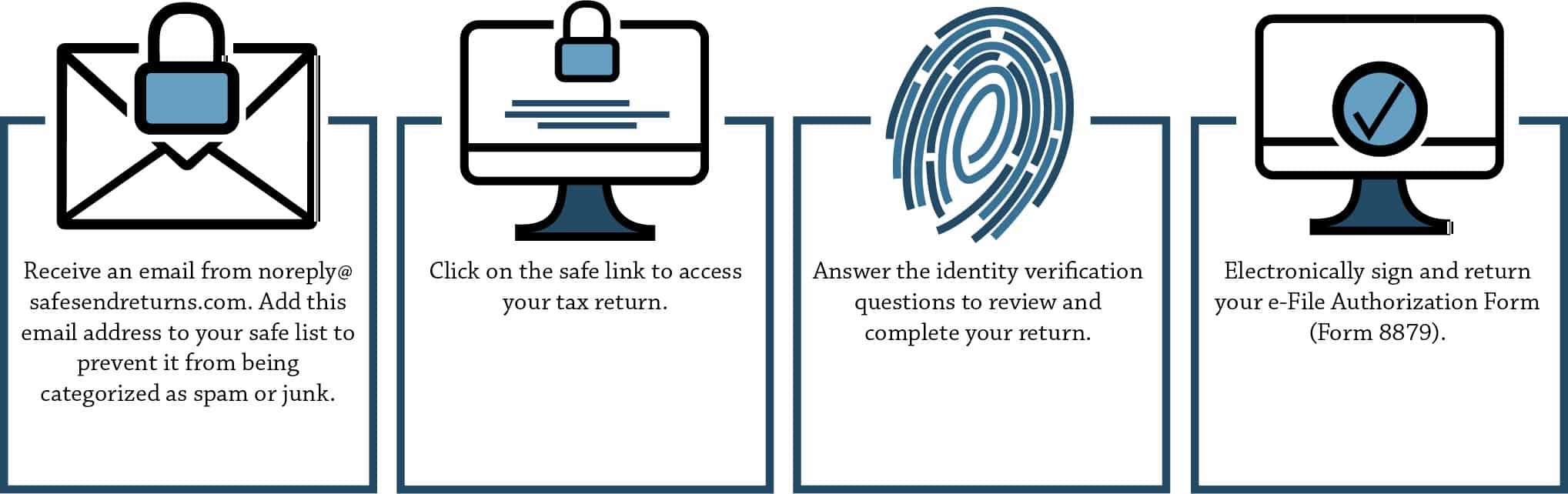

The process for filing your return is simple:

SafeSend conveniently, and securely consolidates all your tax information in one place and allows you to

- Electronically view, sign, save, and print tax documents

- Access your tax return for 7 years

- Receive estimated tax payment reminders at a schedule of your choosing

- Securely forward your tax documents to anyone you choose, such as a bank

- Electronically deliver K-1s

As a firm, we hope you can see the value in this new digital return process and all that it offers. You can refer to the video below for more information on SafeSend and how it works for you.

SafeSend Suite Overview | SafeSend from SafeSend on Vimeo.

Our vision is for SafeSend to become the new normal, however we understand that this may not be feasible for every client in every situation. If you wish to keep things the same as in years past, we will still offer our traditional processing service. As always, we appreciate your trust in us and we look forward to continuing to serve you well.