By Samantha Amador

Scammers are evident these days and pretending to be from the IRS to steal personal information is no exception. To avoid becoming a victim of scammers, everyone needs to be aware of how the IRS actually contacts people.

Here are some facts on what the IRS does do and doesn’t do when making contact:

- The IRS does not initiate contact with taxpayers by email, text messages, or social medical channels.

- The IRS does not threaten to bring in local police, immigration or other law-enforcement to have you arrested for not paying.

- The IRS cannot revoke your driver’s license, business licenses or immigration status.

- The first contact is usually by letter delivered by the U.S. Postal Service. Fraudsters will send fake documents through the mail, and in some cases will claim they already notified a taxpayer by U.S. mail.

- Depending on the situation, IRS employees may first call or visit with a taxpayer. In some instances, the IRS sends a letter or written notice to a taxpayer in advance, but not always.

- Private debt collectors can call taxpayers for the collection of certain outstanding inactive tax liabilities, but only after the taxpayer and their representative have received written notice.

- IRS revenue officers and agents routinely make unannounced visits to a taxpayer’s home or place of business to discuss taxes owed, delinquent tax returns or a business falling behind on payroll tax deposits. IRS revenue officers will request payment of taxes owed by the taxpayer. However, taxpayers should remember that payment will never be requested to a source other than the U.S. Treasury.

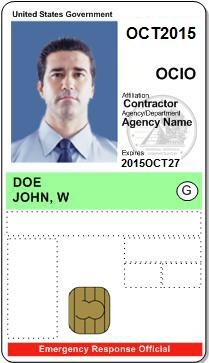

- When visited by someone from the IRS, the taxpayers should always ask for credentials. IRS representatives can always provide two forms of official credentials: a pocket commission and a Personal Identity Verification Credential.

IRS revenue agents or tax compliance officers may call a taxpayer or tax professional after mailing a notice to confirm an appointment or to discuss items for a scheduled audit.